Market Update for Week 36

Market Recap |

Week of Sep. 2 through Sep. 6, 2024 |

|

The S&P 500 index fell 4.2% this week, its largest weekly loss since March 2023, amid worries over weaker-than-expected August job growth and AI demand. The S&P 500 ended Friday's session at 5,408.42. While the weekly drop starts September on a sour note, the market benchmark is still solidly in positive territory for 2024, with a 13% year-to-date climb. The August employment report showed nonfarm payrolls rose by 142,000, missing expectations compiled by Bloomberg for an increase of 165,000 jobs. July and June payrolls were revised downward. Still, the unemployment rate met expectations with a decline to 4.2% in August from 4.3% in July. The technology sector led the weekly drop, falling 7.1% amid concerns that expectations for AI demand may have gotten too lofty, especially after chip maker Broadcom (AVGO) issued Q4 revenue guidance slightly below analysts' mean estimate at the time. Broadcom's stock had the largest percentage drop in the sector, tumbling 16%. The tech slide was followed by a 5.6% drop in energy, a 5% slide in communication services, a 4.8% decline in materials and a 4.4% slip in industrials. In addition to Broadcom, the tech sector's decliners included shares of Monolithic Power Systems (MPWR), which fell 14% on the week as a regulatory filing showed Chief Financial Officer Theodore Blegen sold 2,500 shares for nearly $2.3 million. The energy sector's drop came as crude oil futures also fell. Decliners included shares of APA Corp. (APA), which slid 11%, and Halliburton (HAL), which shed 8%. Consumer staples and real estate were the only sectors that rose this week, edging up 0.6% and 0.2%, respectively. The gainers in consumer staples included shares of Mondelez International (MDLZ), which rose 4.9% as the company's finance chief hinted at upbeat Q3 results at a conference. "I think you will be pleased with the numbers you're going to see in Q3," Mondelez's Luca Zaramella said, according to a transcript via S&P Capital IQ.

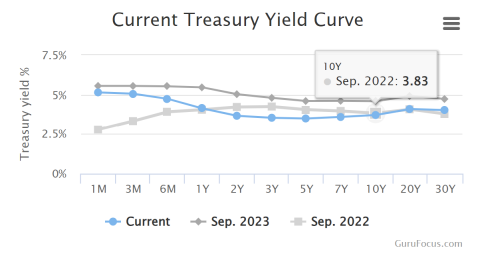

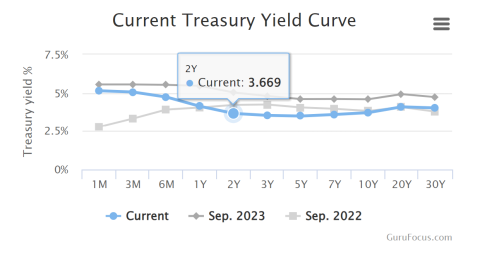

Bond UpdateThe classic definition of an inverted yield curve is when the 10-year rate is less than the 2-year. As you can see below, that is no longer the case. We are back in a normal interest rate environment.

8 months or so overdue, but better late than never, I suppose. (Can you tell I'm still unhappy with the Fed?)

Up NextEconomic data set to be released next week will include August consumer credit on Monday, the August consumer price index on Wednesday, and the August producer price index on Thursday. Also, a preliminary reading of September consumer sentiment will be posted on Friday.

All the Best, Gordon@yourbestpathfp.com

|