Notes ALong the Path: Market Update for Week 28

Market Recap |

WEEK OF JUL. 8 THROUGH JUL. 12, 2024 |

|

The S&P 500 index rose 0.9% this week, trading near records, despite mixed inflation data and bank earnings. The S&P 500 ended the week at 5,615.35. The market benchmark reached a new intraday high at 5,655.56 on Friday but failed to end the session above its record closing level of 5,633.91 reached on Wednesday. The S&P 500 is now up 2.8% in July and 18% this year. Inflation data this week showed US consumer prices declined as forecast last month while June producer prices rose more than expected. The consumer price index slipped 0.1% in June even as analysts were expecting a 0.1% increase. Annually, consumer price inflation slowed to 3% last month from the prior month's 3.3%, cooling more than the 3.1% Wall Street consensus. The US producer price index increased 0.2% in June on a seasonally adjusted basis, compared with the Bloomberg-polled consensus for a 0.1% gain. The producer price index climbed 2.6% annually, accelerating from May's 2.4% growth and exceeding the 2.3% pace that analysts were projecting. The Q2 earnings season began on Friday with reports from JPMorgan Chase (JPM), Wells Fargo (WFC) and Citigroup (C). All three posted Q2 earnings and revenue above analysts' mean estimates but investors still found reasons for concern. JPMorgan's results included a boost from an accounting gain related to an exchange of shares in credit card giant Visa (V). Wells Fargo, meanwhile, said it now expects full-year net interest income to be down 8% to 9%, slightly worse than its prior guidance for a drop of 7% to 9%. The real estate sector had the largest percentage gain this week, up 4.4%, followed by a 3.9% increase in utilities. Other sectors up by at least 2% each included materials, health care, industrials and financials. The gainers in real estate included shares of SBA Communications (SBAC), which rose 12% as the real estate investment trust named corporate controller Saul Kredi as its next chief accounting officer, effective Jan. 1. Kredi will succeed Brian D. Lazarus, who will retire at the end of this year. The utilities sector's gainers included shares of American Water Works (AWK), up 7%, and AES Corp. (AES), which gained 6.7%. Just one sector, communication services, fell on the week with a 3.6% drop. Decliners included shares of Netflix (NFLX), which fell 6.2% even as the streaming technology company's stock received price target increases from analysts at TD Cowen, Goldman Sachs, KeyBanc and JPMorgan.

Up NextNext week, the earnings season will ramp up with reports from companies including Goldman Sachs Group (GS), UnitedHealth Group (UNH), Bank of America (BAC), Morgan Stanley (MS), Charles Schwab (SCHW), Johnson & Johnson (JNJ), Netflix, Novartis (NVS), Abbott Laboratories (ABT) and American Express (AXP). Economic data will include June retail sales, import prices, housing starts, building permits and industrial production.

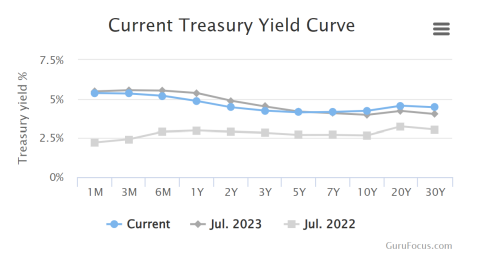

Bond UpdateAs you can see below, the bond market is still very gradually returning to normal with long-term rates rising and short-term rates falling relative to one year ago..

You might ask, "Why do long-term rates and short-term rates move differently?" The answer is that all rates are driven by bond supply and demand. Increased demand means that issuers don't have to offer as high an interest rate to attract buyers. Now, many things can impact the demand for bonds, but for short-term bonds the main driver is that they are a close substitute for money banks borrow at the Fed. Funds rate (5.25-5.50% as of today) and for bonds issued by other relatively reliable countries such as the UK or Germany. Demand for long-term bonds is much more complex and includes their value as substitutes for stocks.

Stay the course! All the Best, Gordon Achtermann, CFP® 703-573-7325 |