Your Best Path Market Recap Vol.3.8 February 19 - 23

Market Recap |

WEEK OF FEB. 19 THROUGH FEB. 23, 2024 |

|

The S&P 500 index rose 1.7% this week to a new record close as stronger-than-expected quarterly results from retailer Walmart (WMT) and chipmaker NVIDIA (NVDA) boosted investor sentiment. The market benchmark ended Friday's session at 5,088.80, its highest closing level on record. The S&P 500 also reached a fresh intraday high on Friday at 5,111.06. The index is now up 5% for the month to date and up 6.7% for the year to date. The consumer staples and technology sectors led the weekly advance amid excitement over the quarterly results from Walmart and NVIDIA. For its fiscal Q4 ended Jan. 31, Walmart reported adjusted earnings and revenue above analysts' expectations. The company also boosted its dividend and unveiled an agreement to acquire entertainment technology company Vizio Holding (VZIO) for $2.3 billion in cash. NVIDIA's shares, meanwhile, rallied on better-than-expected results for the company's fiscal Q4 ended Jan. 28. Sales more than tripled from the year-earlier quarter amid solid demand for generative artificial intelligence, and the company issued upbeat guidance for its fiscal Q1 revenue. NVIDIA's report sent the chipmaker's stock to a $2 trillion market capitalization for the first time and sparked a rally across technology stocks and others touched by artificial intelligence. Every sector of the S&P 500 rose this week, led by a 2.1% gain in consumer staples and a 2.0% rise in technology. Other strong gainers included materials, industrials, and financials. The smallest increase was posted by energy, which edged up 0.4%. In consumer staples, Walmart's shares rose 3.1% on the week amid its better-than-expected earnings report, dividend boost, and Vizio deal. Among other gainers in the sector, Kraft Heinz (KHC) shares rose 3.6% as the food, beverage, and snacks company reiterated its 2024 financial outlook at a conference. The technology sector's advance was led by an 8.5% climb in NVIDIA's shares on the week, followed by an 8.2% increase in fellow chipmaker Micron Technology (MU) shares. The energy sector's small gain came as crude oil futures declined. APA Corp. (APA) Shares shed 4.9% as the company reported Q4 adjusted earnings per share below analysts' mean estimate despite higher-than-expected revenue.

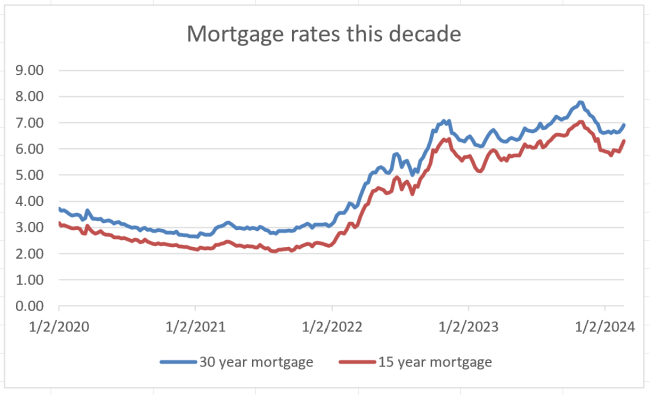

Bonds: Here’s a summary of the bond market for the last week:

Coming Up: Economic data scheduled for next week include January new home sales on Monday, the first revision to Q4 gross domestic product on Wednesday, and the January personal consumption expenditures index on Thursday.

All the Best! Gordon Achtermann, CFP® 703-573-7325 |